IRS Outlines New Regulations for Section 168(k) Bonus Depreciation

November 19, 2019

For the first time ever, tax payers will be eligible to take the full 100% deduction on qualifying property under new Section 168(k) rules.

As part of the Tax Cuts and Jobs Act of 2017, the IRS has released new regulations outlining the act’s 100% bonus expensing rules. The new regulations are an update to the existing Treas. Reg. Section 168(k) rules.

The changes to Section 168(k) allow taxpayers to deduct an additional first-year depreciation, totaling 100%, on qualified property the year it was placed in service. This updated bonus depreciation is only applicable to property that meets the proper requirements.

For more information, read Additional First Year Depreciation Deduction (Bonus) - FAQ from the IRS.

NEW Rule! Used Property Eligible

Prior to the Tax Cuts and Jobs Act of 2017, bonus depreciation rules only applied to new property. One of the most important features in the new update includes the removal of the former sale-leaseback rules, meaning used property is eligible for bonus depreciation. For the first time ever, tax payers will be eligible to take the full 100% deduction on qualifying used property.

For more information on the rules regarding “new to you” property, read this guide from Cherry Bekaert, LLP: IRS Released Proposed Regulations for Section 168(k) Bonus Depreciation

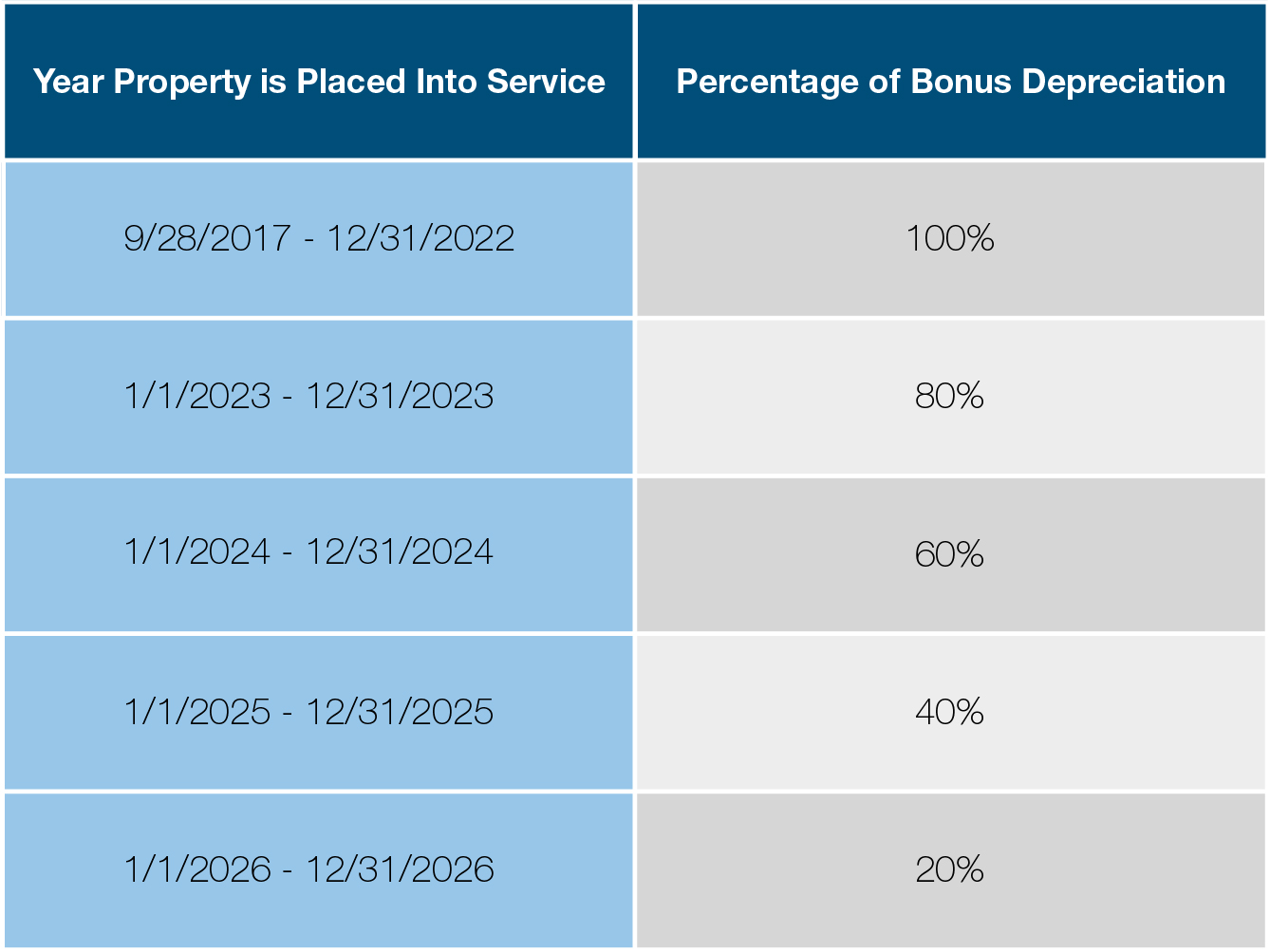

Bonus Depreciation Schedule

Under the new Tax and Jobs Act of 2017, the modified bonus depreciation will hold at 100% until 2022 and gradually decrease in subsequent years.

Maximize Section 168(k) by Dec. 13, 2019!

Don’t miss out on valuable Section 168(k) savings in 2019! Med Vest Technology representatives are ready to help you find the best medical equipment options for your facility. The last shipping day of the year for capital medical equipment at our Louisville facility is Friday, Dec. 13, 2019.